Mortgage Financing Options

Financing Options To Fit Your Plans and Budget

At Home State Bank we have a lot of mortgage options available to us, which means we can find the mortgage that’s right for you. Take a look and see which ones fit your plans and budget.

Fixed-Rate Mortgages

Fixed-rate mortgages have a constant interest rate and monthly payments that never change.

First-Time Homebuyer Program (Minnesota Housing Finance Agency (MHFA)

Home State Bank is an approved lender for Minnesota’s First-Time Homebuyer Program, helping families finance down payments, closing costs, and home repairs. Contact your mortgage expert today for more information.

Rural Development Guaranteed Loans (RD)

Home State Bank is an approved lender for the USDA Rural Development Guaranteed Loan program, helping people become homeowners by insuring mortgages. There are lots of reasons to ask your Home State Bank mortgage expert for an RD loan:

- Great for First-Time Home Buyers

- 100% Financing (including Closing Costs)

- No Down Payment Requirements

- No Prepayment Penalties

- Low Rates

- Existing Homes, Foreclosures and New Construction.

Home Equity Loans

Unlock the Possibilities with a Home Equity Loan. When you take out a Home Equity Loan or Line of Credit, you can use your home’s equity to unlock your dreams. You can remodel your kitchen, tour the wineries in the south of France, or even enjoy lake life in your new boat. The possibilities are endless!

Home Equity Term Loan: This is a fixed interest rate loan that allows you to borrow against your home’s equity for a variety of uses.

Features

- May be able to access up to 80 percent of the equity in your home.

- Various fixed loan terms available

- Low-interest rates

- Fixed payments

- Loan funds are disbursed in a single advance upfront- making it an ideal option for when you have a specific project or expense in mind.

Home Equity Line of Credit (HELOC): This is a variable rate revolving line of credit secured by the equity in your house.

Features

- No annual fee.

- Set credit limit.

- May be able to access up to 80 percent of the equity in your home.

- Low-interest rates-lower than most credit cards.

- Flexibility- borrow only what you need when you need it.

- Quick and convenient access to funds both now or into the future through your Home State Bank deposit account.

- Does not impact your current mortgage rate or terms.

You have worked hard to build this equity; now, it is your turn to enjoy the many benefits of having a Home Equity Loan.

Contact a Lender Today to Learn About Your Options!

Fix-Up Home Improvement Loans

Whether you need to make necessary repairs or simply want to update your home, a Fix-Up loan can finance most home improvement projects. The Fix Up loan's low, fixed interest rates and longer repayment terms (up to 20 years on some loans) means lower and more affordable monthly payments.

- Affordable, fixed interest rates

- Lower rates for eligible energy efficiency and accessibility improvements

- Loan amounts from $2,000 to $75,000

- Secured and unsecured loan options

- Little to no equity in your home needed

- Higher loan-to-value ratio on secured loans than traditional loan products

- Repayment terms up to 20 years

- Finance projects already started, or that were completed within 120 days

- Hire a contractor or do the work yourself

- No prepayment penalty

What improvements can I make?

Here are some examples-ask your lender if your project is eligible.

General Home Repairs and Remodeling

- Wiring Updates

- Awnings

- Brick repair-replacement

- Painting

- Stucco Repair

- Air exchanger

- Chimney repair or replacement

- Ductwork

- Fireplace

- Heat pumps: air, geothermal, ground water

- Countertops

- Drywall

- Floor covering

- Kitchen cabinets

- Landscaping

- Septic system repairs or replacement

- Bathroom Fixtures

- Bathtubs/Enclosures/Shower doors

- Water conditioner

- Well replacements

- Fascia

- Gutters

- Porches and Decks

- Finishing a Basement

- Siding and Roofing

- Driveway repairs

- Sidewalks

- Garage

- Mold and radon mitigation

- Tree removal or trimming

Energy Efficiency Improvements

- Heating System and Central Air Conditioning

- Windows

- Insulation, Attic Air Sealing

- Water Heater

Accessibility Improvements

- Ramps

- House Accessibility Modifications

- Safety Modifications

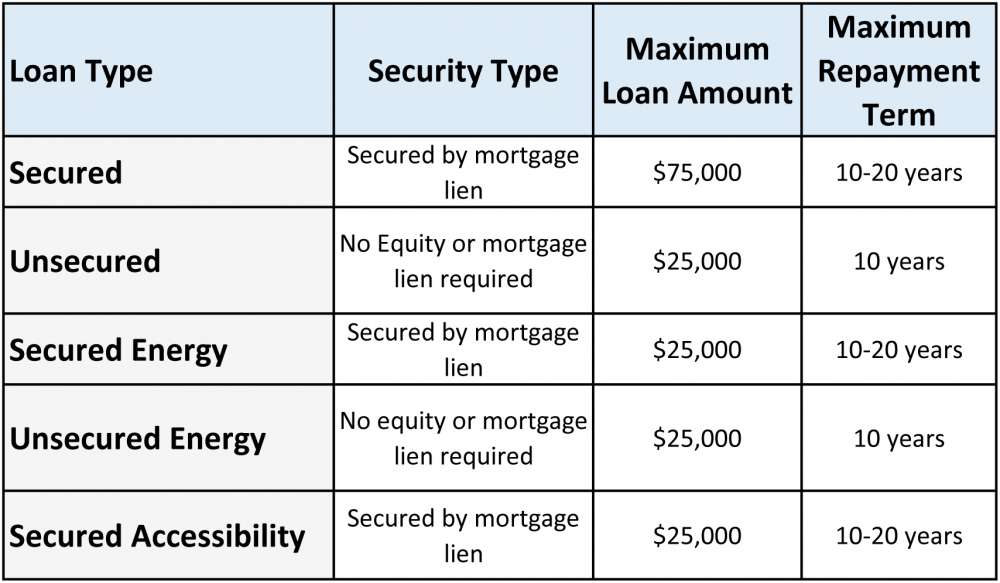

Which Fix Up Loan is right for me?

Income and program requirements subject to change. Please inquire or see www.mnhousing.gov for more information.

That sounds great! Am I eligible?

You may be eligible for a Fix Up Loan if you:

- Own and occupy the property to be improved (single-family homes, duplexes, triplexes, and fourplexes are eligible)

- Meet minimum credit score requirements

- Meet our income limits-they're higher than you might think (and no income limit for eligible accessibility and energy efficiency improvements)

How do I get started?

- Complete the paper application or the online application

- Feel free to contact us, or we will reach out to you once we receive your application.

- Get Bids. Obtain contractor bids or detailed materials estimates from a building supplier for work.

- Mission Accomplished! Finish up the paperwork with your lender, make your home improvements, and celebrate your accomplishment.

© 2024

© 2024